.png)

Apr 7, 2024

When initiating the Swiss company registration, meticulous consideration of the expenses involved is paramount.

A comprehensive business plan necessitates the inclusion of all foreseeable costs, with taxes being a significant component. Integrating tax projections into financial forecasts is imperative for a thorough understanding of the business's trajectory and potential profitability of a Swiss company.

To estimate projected taxes, particularly concerning corporate taxation, it's essential to grasp the Swiss taxation framework while considering setting up a company in Switzerland as a foreigner.

calculated as a percentage of the Swiss company's profits, constitutes a significant aspect of income tax. This tax, applicable to public limited companies and limited liability companies from the moment of Swiss company formation in the Switzerland business registry, encompasses net profits and commercially justifiable expenses.

Apr 07, 2024

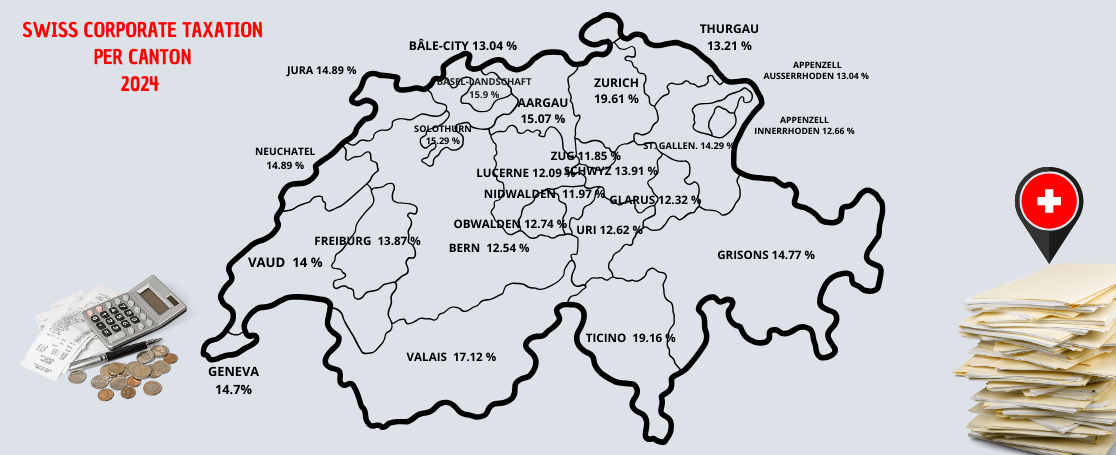

Before setting up a company in Switzerland, let's outline the fundamentals of corporate taxation in Switzerland. At the national level, limited companies and cooperative societies are subject to a federal tax rate of 8.5%, while other legal entities face a rate of 4.25%. Cantonal and municipal tax rates vary significantly, providing businesses with opportunities to optimize their tax burdens based on their operational locations after Swiss company registration.

Navigating corporate taxation in Switzerland requires a nuanced understanding of the tax landscape in each canton. While Zurich, Geneva, Zug, Basel-Stadt, Vaud, and Lucerne represent just a few examples, each canton offers unique incentives and tax rates for businesses. By leveraging professional expertise from company formation in Switzerland to strategic tax planning, companies can optimize their tax strategies and capitalize on Switzerland's business-friendly environment to drive the growth and success of a Swiss company.

Capital tax is not imposed at the federal level but rather by the cantons. This tax applies to share capital or equity capital and includes declared reserves.

Entities subject to capital tax include:

Value-added tax (VAT) in Switzerland is a consumption tax levied on the sale of goods and services. It is a crucial component of the Swiss tax system and is governed by the Swiss Federal Tax Administration (SFTA)

As of January 1, 2024, Switzerland has updated its Value Added Tax (VAT) rates. The changes are as follows:

1. Standard Rate: Increased from 7.7% to 8.1%.

2. Reduced Rate: Increased from 2.5% to 2.6%. This rate applies to essential goods and services such as foodstuffs (excluding alcoholic beverages), livestock, grains, seeds, and medications.

3. Special Rate for Accommodation: Increased from 3.7% to 3.8%. This rate applies to accommodation services like overnight stays in hotels including breakfast.

These changes are aimed at aligning tax policies with current economic needs and ensuring adequate revenue generation. The VAT rates are determined based on the time the service is rendered. Services provided before January 1, 2024, are taxed at the previous rates, while those provided after this date are taxed at the new rates.

Understanding the VAT system is essential before registering a company in Switzerland and for businesses operating in Switzerland, ensuring compliance and efficient tax management.

Withholding Tax Rates in Switzerland

Withholding tax in Switzerland is a federal tax applied to specific types of income. The main categories and their respective rates are as follows: